The phrase “prevent foreclosure ” is full of promise and hope to homeowners who fear they may be in danger of losing their home. Fortunately, there are several options available for those looking to keep their home and stay out of foreclosure. The following strategies can help prevent a foreclosure and put the homeowner back on a path to financial success.

Reach Out to Your Creditors Early On

When it comes to preventing foreclosure, an ounce of prevention is worth a pound of cure. The fastest way to prevent foreclosure is to contact your creditors as soon as you realize you may have difficulty paying your mortgage. Many lenders want to work with borrowers who are in difficult situations, so don’t hesitate to ask for help. Contact your loan servicer to explain your situation and inquire about available options.

Examine Your Financial Situation

One of the first steps you should take in order to prevent foreclosure is to look closely at your current financial situation and budget. Create a detailed budget to better understand your income and expenses. This will give you a clear picture of how much extra money you can allocate toward your mortgage payments each month. Additionally, review all of your debt obligations to determine which accounts need the most attention.

Look Into Forbearance Programs

Forbearance programs are one of the most effective ways to avoid foreclosure. These programs allow you to stop making payments temporarily while continuing to own your home. You’ll have time to catch up on missed payments, get back on track financially, and keep your home. Contact your lender to find out if they offer forbearance programs or any other form of relief.

Explore Refinancing Options

If your current mortgage is too expensive or beyond your means, refinancing may be an option to consider. Refinancing can reduce your interest rate, extend the length of your loan, and lower your monthly payments. If you decide to refinance, shop around for the best rate and terms to ensure you get the deal that works best for you and your budget.

Ask for Help from Other Resources

Many local, state, and federal government programs exist to assist homeowners facing foreclosure. In some cases, these programs provide counseling assistance, legal assistance, temporary cash grants, or even debt forgiveness. Research your local resources to see if any of the programs can provide assistance in preventing foreclosure.

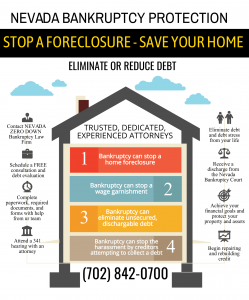

Seek Professional Help

There are many professionals who specialize in helping homeowners prevent foreclosure. Whether you need assistance in negotiating with creditors or advice on filing bankruptcy, an experienced professional can help. Consider consulting an attorney, bankruptcy expert, or housing counselor for advice on how to best address your situation.

There’s no question that preventing foreclosure is a long and arduous process. However, by taking proactive steps and having a plan in place, you can successfully keep your home and avoid foreclosure. By pursuing options like seeking help from creditors, examining finances, and exploring refinancing, you can put yourself in the best possible position to prevent foreclosure and move forward to financial freedom.